Gangway Injury Attorney

If you have been on a cruise ship or commercial vessel, you likely walked on the ship’s gangway. A gangway is like any other part of a ship –...

Read More

Being the victim of bad faith insurance practices or a maritime accident is stressful. We fight big insurance and utilize our experience and specialization to help people overcome legal challenges when they are at their lowest moment. We have helped hundreds of clients obtain the recovery that they need.

Please contact us if you are ready for free, noncommittal consultation with an attorney.

The term bad faith is often used to describe insurance claim practices. We understand what that means and how to guide clients through complicated insurance claims that have been denied, delayed, or underpaid. Through our practice, we have:

Maritime law is a unique field that requires knowledge and experience to ensure the best result possible. Our attorneys hold advanced degrees in the field of maritime law and began their careers representing some of the largest maritime companies, employers, and insurance carriers. Through our maritime practice, we have:

Our firm has a narrow focus and embraces technology so we can better serve our clients. By limiting our practice to insurance recovery and maritime law, we are able to obtain better results for our clients. We strive to be available to our clients to allow a client-focused experience that connects with people on their terms.

Most people who hire an attorney want to know in advance how much it will cost and hate the idea of the “billable hour.” We primarily represent clients on contingency. This means we are not paid a fee unless we recover money for you. We prefer this method of fee because it rewards results, not time. Clients often prefer this type of fee because no money is paid to the attorney until the case is completed.

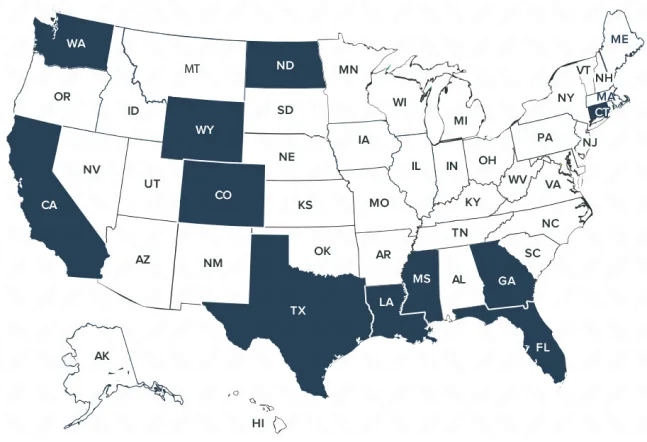

Our attorneys are licensed in 12 states and are physically located on the Atlantic, Gulf, and Pacific. We accept insurance, maritime, and other cases throughout the United States and often take on cases that other attorneys turn down. Let our specialization, knowledge, and experience work for you.

contact usMy house was seriously damaged during a storm. After fighting the insurance company for several months, I hired The Johns Firm, LLC. Jeremiah filed a lawsuit against the insurance company and a few months later, my case settled for several hundred thousand dollars.

— MARGARET L.I was injured while a passenger on a cruise ship. Jeremiah worked hard on my case beginning to end. I was surprised how easy it was to get in touch with him. After about a year of fighting the cruise ship company, I received a large six-figure settlement.

— ANONYMOUSIf you have been on a cruise ship or commercial vessel, you likely walked on the ship’s gangway. A gangway is like any other part of a ship –...

Read MoreThe Jones Act is a cornerstone of U.S. admiralty law, providing a number of crucial protections for maritime workers. That said, navigating the intricacies of the Jones Act is...

Read MoreBeing injured at sea can be physically, emotionally, and financially devastating. Medical bills add up, time off work takes its toll, and the pain and suffering complicate matters further....

Read More